In an Initial Public Offering (IPO), the object clause serves as a window into a company’s strategic priorities. This section of the Draft Red Herring Prospectus (DRHP) reveals how a company intends to allocate the proceeds from its public offering, and it holds particular significance for both the company and potential investors. For investors, understanding the alignment between object clauses and strategic priorities is key to assessing the long-term viability and growth potential of IPO-bound companies.

However, the emphasis on specific use cases—such as capital expenditure (CapEx), research and development (R&D), working capital, and debt repayment—varies considerably across industries. Understanding these distinctions is essential for aligning the object clause with broader strategic goals and investor expectations.

By examining the object clauses across industries such as Manufacturing, Technology, Pharmaceuticals, Retail, Real Estate, and Infrastructure, we can observe clear trends that highlight the differing operational needs and growth objectives within each sector.

Key Observations: Object Clause Allocation Across Industries

To understand how allocation of objects clauses is done it is necessary to study objects clause of recent IPOs. In this regard examination is done of recent IPOs, to identify emerging patterns in investment strategies and evaluate how effectively companies align their object clauses with their growth ambitions.

The IPOs chosen for this analysis are taken from diverse sectors to enhance our understanding of capital market trends, investor confidence, and sector growth opportunities. This analysis focuses on IPOs launched between July 16, 2024, and September 19, 2024, providing insights into current market dynamics shaped by recent economic conditions and regulatory changes. The selected IPOs, ranging from ₹1,500 million to ₹75,000 million, represent a diverse array of companies, from small to large enterprises. A comparative analysis of the object clauses in various industries reveals unique approaches to how proceeds are used, based on industry-specific operational demands.

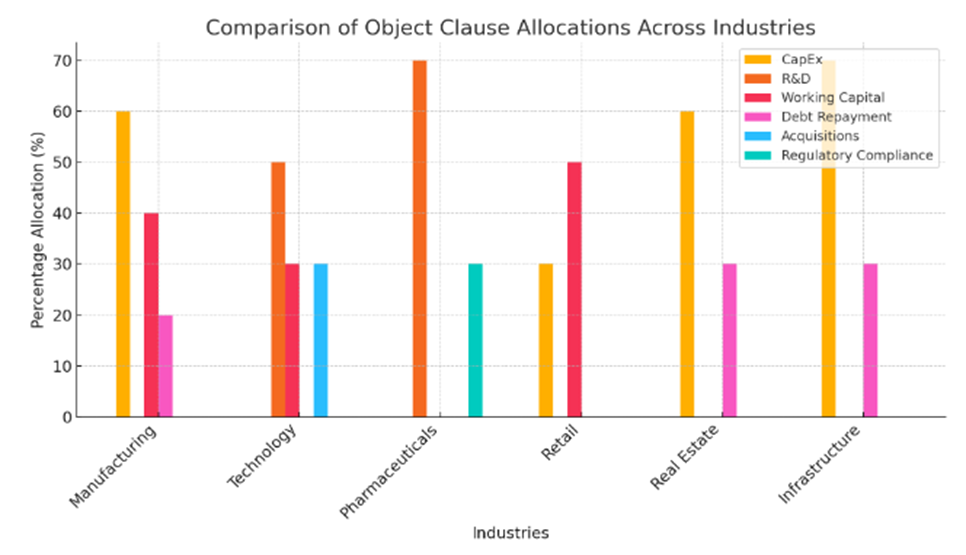

The table below presents a breakdown of common object clause allocations across industries:

| Industry | CapEx | R&D | Working Capital | Debt Repayment | Acquisitions | Regulatory Compliance |

| Manufacturing | 50%-60% | – | 30%-40% | 10%-20% | – | – |

| Technology | – | 40%-50% | 20%-30% | – | 20%-30% | – |

| Pharmaceuticals | – | 60%-70% | – | – | – | 20%-30% |

| Retail | 20%-30% | – | 40%-50% | – | – | – |

| Real Estate | 50%-60% | – | – | 20%-30% | – | – |

| Infrastructure | 60%-70% | – | – | 20%-30% | – | – |

The following graph visually compares how different industries allocate their IPO proceeds, highlighting the diverse strategic priorities across sectors.

This data illustrates the distinct strategic priorities of each sector. To further contextualize these insights, let’s explore how each industry aligns its object clauses with its long-term goals and operational needs.

Manufacturing: Capital-Intensive Growth

Manufacturing companies are capital-intensive by nature, and their object clauses frequently emphasize Capital Expenditure (CapEx). With 50%-60% of IPO proceeds typically directed towards expanding production capacity or upgrading existing infrastructure, CapEx is crucial for maintaining competitiveness and meeting rising demand.

- Strategic Goal: The focus on CapEx ensures operational scalability, enabling manufacturing companies to increase production volumes and achieve cost-efficiency through automation and technology upgrades.

- Working Capital: Additionally, around 30%-40% of proceeds are allocated to working capital, which ensures smooth operations by funding raw material purchases and managing cash flow through demand fluctuations.

Manufacturing firms clearly aim to optimize their operational efficiency through infrastructure improvements, positioning themselves for long-term growth.

Technology: Innovation-Driven Growth

For technology companies, research and development is the lifeblood of innovation, and object clauses reflect this emphasis. With 40%-50% of proceeds often allocated to R&D, tech firms prioritize the development of new products, platforms, and technologies to stay ahead of rapidly evolving market trends.

- Strategic Goal: Innovation is central to maintaining market leadership. Whether it’s advancements in AI, cloud computing, or cybersecurity, these firms channel their resources into staying on the cutting edge.

- Acquisitions: Many tech companies also allocate 20%-30% of proceeds for strategic acquisitions, often targeting smaller companies with specialized technologies or intellectual property that can complement their existing portfolio.

This focus on innovation and market consolidation makes technology firms particularly appealing to investors who prioritize long-term growth and product development.

Pharmaceuticals: Long-Term R&D Commitments

The pharmaceutical sector, similar to technology, heavily relies on research and development for its long-term success. With up to 70% of IPO proceeds dedicated to research, drug discovery, and clinical trials, pharmaceutical companies allocate substantial resources to the development of new therapies.

- Strategic Goal: Pharmaceuticals operate with extended timelines for revenue realization, as drug development and regulatory approvals are resource-intensive processes. This emphasis on R&D reflects the industry’s long-term focus on breakthrough products.

- Regulatory Compliance: A significant portion of funds is also earmarked for navigating the regulatory landscape, ensuring that new drugs receive the necessary approvals in global markets.

Pharmaceutical companies’ commitment to R&D underscores the strategic importance of innovation and compliance in an industry with high barriers to entry.

Retail: Operational Agility and Brand Expansion

In contrast, retail companies focus heavily on working capital, often directing 40%-50% of proceeds toward ensuring liquidity for inventory management, especially during high-demand periods such as holidays or promotional sales.

- Strategic Goal: The emphasis on working capital ensures that retail firms can meet consumer demand and manage supply chains efficiently, while also investing in new product launches.

- Brand Expansion: Around 20%-30% of IPO funds are typically allocated to marketing and brand expansion efforts, allowing retailers to capture more market share and expand into new regions.

For retail companies, maintaining liquidity and leveraging their brand are key to sustaining operational flexibility and scaling efficiently.

Real Estate and Infrastructure: Capital and Debt Management

Both Real Estate and Infrastructure sectors are highly capital-intensive, and their object clauses largely emphasize CapEx and debt repayment.

- CapEx: In both industries, 60%-70% of IPO proceeds are often directed towards developing new projects—whether it’s residential or commercial real estate in the case of property developers, or large-scale public utility projects in the case of infrastructure firms.

- Debt Repayment: An additional 20%-30% of proceeds are allocated to repaying existing debt, which is common in industries that rely on leveraged financing for large-scale developments.

These sectors focus on long-term project completion and financial health, using IPO proceeds to fund expansion while reducing debt burdens.

This can be summarized in the table below, which outlines the key areas of focus, allocation of IPO proceeds, and strategic goals for each sector.

| Allocation | Strategic Goal | |

| Sector | Manufacturing | |

| Primary focus | Capital Expenditure (CapEx) – 50%-60% directed towards expanding production capacity or upgrading infrastructure | Operational scalability, cost-efficiency through automation and tech upgrades |

| Secondary focus | Working Capital – 30%-40% for raw material purchases, cash flow management | Maintain smooth operations during demand fluctuations |

| Sector | Technology | |

| Primary focus | Research & Development (R&D) – 40%-50% allocated to product development, platforms, and new technology innovations | Maintain market leadership through innovation |

| Secondary focus | Acquisitions – 20%-30% for acquiring specialized technologies or IP | Expand market reach and complement existing product portfolio |

| Sector | Pharmaceuticals | |

| Primary focus | Research & Development (R&D) – Up to 70% dedicated to drug discovery, clinical trials, and product development | Long-term R&D for breakthrough drugs, focus on revenue realization |

| Secondary focus | Regulatory Compliance – Funds allocated for obtaining regulatory approvals in global markets | Ensure compliance and timely market entry for new therapies |

| Sector | Retail | |

| Primary focus | Working Capital – 40%-50% to ensure liquidity for inventory management and to handle demand fluctuations | Meet consumer demand, supply chain management, product launches |

| Secondary focus | Brand Expansion – 20%-30% for marketing and expanding brand reach | Capture more market share and expand into new regions |

| Sector | Real Estate & Infrastructure | |

| Primary focus | Capital Expenditure (CapEx) – 60%-70% allocated for project development (real estate or public utility projects) | Project completion and expansion |

| Secondary focus | Debt Repayment – 20%-30% for repaying existing debt burdens | Improve financial health and reduce debt burden through repayments |

Conclusion

In conclusion, a company’s object clause is more than just a formal declaration; it reflects strategic intentions that can shape its trajectory post-IPO. Industries like Manufacturing and Infrastructure focus heavily on capital expenditure to ensure scalability, while technology and pharmaceutical sectors emphasize innovation and research for long-term growth. Retail firms, in contrast, prioritize liquidity and brand expansion to maintain agility in competitive markets. For investors, understanding how a company allocates its IPO proceeds is essential for assessing its operational priorities and growth potential. By aligning object clauses with sector-specific strategic goals, both companies and investors can navigate the IPO process with clearer expectations of future performance and stability.

This article has been published on Taxmann. The link for the same