Introduction

Initial Public Offerings (IPOs) have long been a cornerstone of the financial markets from decades, offering Companies a pathway to raise capital and to investors, an opportunity to participate in the growth story of emerging businesses. One of the most talked-about aspects of IPOs is the phenomenon of “listing gains” – the profit investors make when the stock price rises significantly on its debut trading day. The quick profit on the listing day makes it more attractive.

The listing gain remained an unsolved puzzle for the retail investor basically, it offers the gains on the listing day, but it drives its value from other factors too and its conundrum for both investors and market regulators.

a successful IPO with significant listing gains can be a badge of honor, signalling strong investor confidence and market demand. It can also enhance the company’s reputation, making it easier to raise additional capital in the future as well.

Before discussion on listing gains, it’s crucial to understand the IPO process. so, companies go public for various reasons, some of them are, to raising capital for expansion, increasing visibility and credibility, providing liquidity to early investors, and attracting talent through stock options, continued business in the long run, to make brand image of the Company. The IPO process involves appointing investment banks as underwriters who manage the IPO, including valuation, regulatory filings, and distribution of shares. Valuation is one of the factors, often employing a combination of discounted cash flow analysis, comparable company analysis, and precedent transactions. However, IPO valuation is as an art cum science, susceptible to biases and market sentiment. Underwriters play a crucial role in this process, balancing the issuer’s desire for a high valuation with the need to ensure a successful offering. 1As per the reports of the SEBI, Between April 2021 and December 2023, 144 IPOs were listed, with 75% (108 IPOs) delivering positive returns. In fact, 26 of these IPOs saw more than a 50% gain on their listing day. however some IPOs underperformed after listing, this didn’t dampen the excitement for new IPOs. A total of 92 IPOs were oversubscribed by more than 10 times, while only 2 IPOs were undersubscribed.

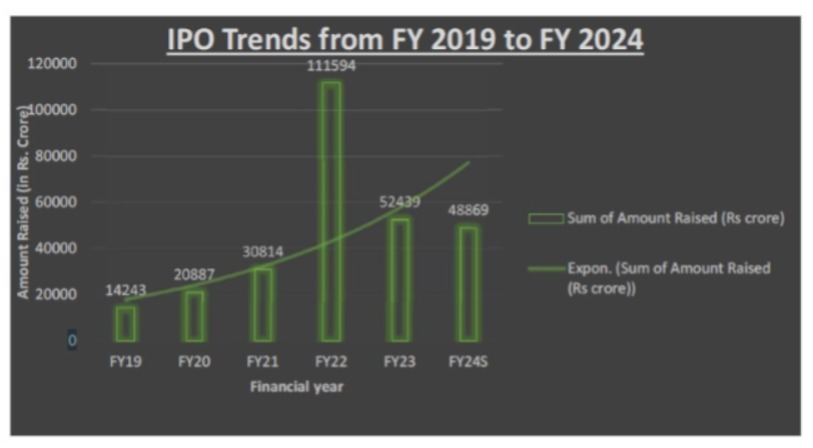

2In 2023-24, total 272 companies raised money through IPO as compared to the 164 companies in 2022-23, The small and medium enterprises (SME) segment recorded highest-ever resource mobilization of 6,095 crore by way of 196 initial public offers (IPOs) in 2023-24.

- Analysis of Investor Behavior in Inial Public Offerings (IPOs), Department of Economic and Policy Analysis

- SEBI Annual Report 2023-24

As per the reports, there was a positive correlation between the listing gains in the first week and the percentage of shares sold within that week by Retail and NII category investors. 3It can be seen that about 54% of IPO shares (in value terms) allotted to Investors (excluding anchor investors) were sold within a week from listing. Mutual funds typically hold IPO shares for a longer period, while banks tend to sell them quickly. Within a week, mutual funds sold only 3.3% of their allotted shares, whereas banks sold 79.8%.

Individual investors sold 67.6 per cent shares by value allotted to them within a week, when returns were more than 20 per cent and sold 23.3 per cent shares by value, when returns were negative

Analysis of Investor Behavior in Inital Public Offerings (IPOs), Department of Economic and Policy Analysis

THE REPORTS OF THE REGULATORY AUTHORITIES ARE SAYING THAT THERE IS POSITIVE CORRELATION BETWEEN THE LISTING GAINS IN THE PAST YEAR BUT IS IT TRUE AS A WHOLE?

The term listing gains raised some interesting question, some of them are

- Does the listing gains is a sign of that the company is well governed by its Promoters

- Whether listing of shares on over and above reflecting a healthy market sentiment

- Does factors like market sentiments and emotional aspect also affect the price movement.

- Why do some IPOs deliver spectacular listing gains while others flop? Is it predictable? Are they sustainable?

- Who Benefits from listing?

- Does listing gains Distract investors from the fundamental value of the Company?

- Listing gains Vs Long-Term Performance?

THE REASONS BEHIND LISTING GAINS ARE MULTIFACETED:

Underpricing: Underwriters deliberately underprice the IPO to ensure full subscription and create positive buzz.This leaves “money on the table” for initial investors but reduces the risk for the underwriter

Lack of Information: Issuers and underwriters possess more information about the company’s prospects than potential investors. This lack of information can lead to mispricing, with investors potentially undervaluing the company during the IPO process.

Market Sentiment and Momentum: IPOs are affected by market trends and investor interest. in a strong market, stock prices can go up quickly, leading to high listing gains. Many investors buy rising stocks, which pushes prices even higher.

Positive listing: A large listing gain can be interpreted as a positive signal about the company’s future prospects, attracting more investors and further driving up the price.

Speculation: Some investors participate in IPOs solely to capitalize on listing gains, quickly selling their shares for a profit. This “flipping” behavior can contribute to the initial price surge.

Media Coverage and Hype: Media hype can inflate investor enthusiasm driving up demand for an IPO and leading to inflated listing gains, regardless of the company’s true value.

Greater fool theory: as per this theory, investment can be bought at an inflated price, with the hope that there will always be someone willing to buy it at an even higher price. The theory based on the idea that prices are not always based on the intrinsic value of an asset, but rather on the belief that there will be another buyer willing to pay more.

Grey Market Premium (GMP): it is a price difference between an IPO’s issue price and its expected trading price in the unofficial, pre-listing market. It indicates investor sentiment

before the official debut.

THE DARK SIDE OR THE MYTH OF LISTING GAINS

Volatility and Sustainability: Listing gains are often short-lived. High initial prices can be unsustainable, leading to sharp corrections and losses for late entrants.

The Bubble Trap: Exaggerated listing gains can create a speculative bubble, detaching the stock price from fundamentals and setting the stage for a painful crash.

Limited Information: Insiders and institutional investors often have more information than retail investors, giving them an advantage and potentially leaving retail investors holding the bag.

Losses for Retail Investors: Retail investors, often late to the market can be particularly vulnerable to the volatility and bubbles associated with listing gains, facing significant losses when the hype subsides.

Market manipulation: Sometimes, listing gains can be artificially inflated through manipulative practices, creating a false sense of demand and trapping unsuspecting investors.

Neglect of fundamentals: Focusing solely on listing gains can distract investors from the company’s underlying fundamentals, such as its financial health, competitive landscape, and long-term growth prospects.

Disposition effect: There is a tendency among the investor that they are selling the assets that have made financial gains, while holding on to assets that are losing money.

SOME PRACTICAL EXAMPLES IN INDIAN CONTEXT :

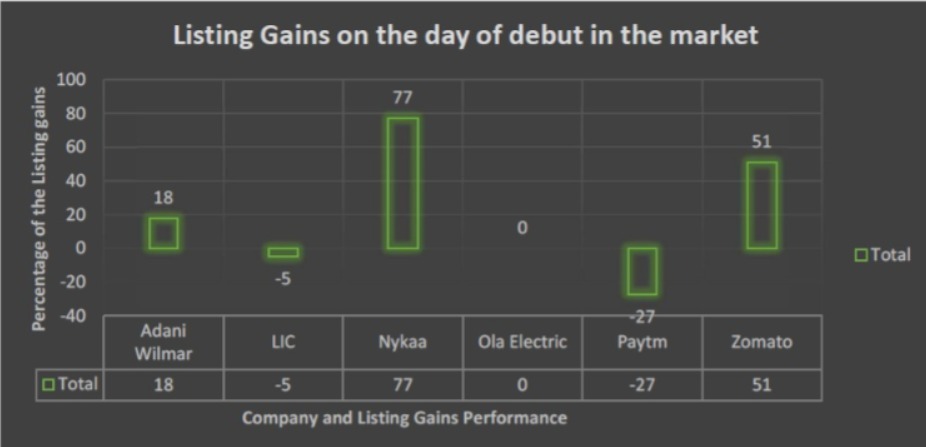

Zomato’s 2021 IPO, priced at ₹76, saw an initial 51% gain, but its stock later fell below ₹100 per share due to concerns about profitability and competition from Swiggy. Paytm’s ₹18,300 crore IPO also faced a disastrous debut, with a 27% drop in share price on listing day. Despite being India’s largest fintech company, Paytm’s stock continued to underperform, highlighting the risks of overvaluation and speculative market behaviour. In contrast, Nykaa’s IPO in 2021 proved to be a rare success, with a 77% gain on its first day and some sustained upward momentum, driven by the company’s strong brand and its positioning in India’s growing beauty and e-commerce markets. However, over time, the stock faced fluctuations and a general downtrend, as the broader market corrected and concerns about e-commerce valuations grew.

The LIC IPO, India’s largest public offering in 2022, low investor demand with the stock opening at a discount to the issue price. It struggled to sustain its listing gains and continued to face downward pressure as concerns over its long-term growth and market competition emerged.

Adani Wilmar’s stock saw a significant surge. The stock opened at ₹270 per share, marking an 18% increase from its issue price of ₹230 on listing day. This initial listing gain reflected strong investor demand, especially considering Adani Wilmar’s robust market position in India’s growing edible oil and packaged food sector, thereafter the stock faced a deep downtrend due to the news of Hindenburg Research, the US investment firm known for its short-selling activities.

Ola Electric IPO in 2024, even after the visibility OLA have in the market but still the IPO was listed at Rs. 76 at par and there are no listing gains and thereafter the market sentiments taken it to the next level trading at a price of more than Rs.150 but due to some realty check the price again came to its real value These examples highlight the challenges and risks involved in IPO investments. While listing gains can be lucrative, investors need to be cautious and evaluate the fundamentals of the company, the sector, and the overall market conditions to avoid being caught in speculative hype and ensure long-term success.

Investing in IPOs: A Prudent Approach (For the Informed Investor)

Due Diligence is Key: To be an informed investor focus on, Scrutinizing the prospectus, Financial Statements, Business Model, Management Team, Industry Analysis rather than focusing solely on marketing materials

Not Chasing Listing Gains: Avoid Emotional Decisions, Focus on Long-Term Value.

Diversification: Diversify Across Asset Classes, do not allocate a significant portion of the portfolio to a single IPO, setting a limit on the percentage of portfolio that should be allocated to IPOs.

Consideration to the Valuation: Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and Discounted Cash Flow (DCF) analysis, Comparison with the Peers, avoiding Overvaluation.

Long-Term Perspective: IPO investments as long-term investments, ignore Short-Term Volatility, periodically reviewing the IPO investments to ensure risk and return ratio.

Understanding the Business and Industry: Before jumping into an IPO, it’s essential to grasp the business model and long-term viability of the company going public. Evaluate the company’s position within its industry, its growth potential, competitive advantages, and any emerging trends that could impact the market.

Conclusion :

Listing gains remain a complex and often unpredictable phenomenon influenced by multiple factors, including market sentiment, pricing strategies, investor behaviour, and broader economic conditions. the sustainability of gains has remained questionable, as some IPOs deliver long-term value while others decline after the initial surge. A prudent approach to IPO investing demands thorough research and a long-term perspective, rather than chasing shortterm gains. Investors should deeply analyse financial statements, business models, and industry

trends to make more informed decisions Over-reliance on listing gains can lead to irrational investment decisions, exposing retail investors to market volatility and potential losses. Unless the investors need to be prudent while making the investment decision, the IPO listing gains will remain a conundrum for the investor and the regulator too.

This article has been published on Taxguru. The link for the same