Introduction

An Initial Public Offering (IPO) marks a major milestone in a company’s growth journey. By offering shares to the public and getting listed on the stock exchanges, a company gains access to capital while also taking on new responsibilities. One of the most crucial duties after an IPO is maintaining transparency with shareholders. This means the company must follow the rules and regulations set by regulatory bodies like the Securities and Exchange Board of India (SEBI) to ensure trust and compliance in the market.

To ensure a smooth IPO process, a company must start preparing well in advance—long before submitting its Draft Red Herring Prospectus (DRHP). Early preparation helps avoid regulatory non-compliance after listing. This involves several key steps, such as maintaining accurate financial records, meeting IPO eligibility criteria (including those for promoters and directors), ensuring the right board composition, establishing policies, and setting up essential committees. Proper planning streamlines the IPO journey. In this article, we will discuss how a company should prepare for an IPO by structuring its Board of Directors before going public.

Legal requirements for the Board of Directors

Composition of board of directors is governed by Regulation 17, 17 A of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 (SEBI LODR Regulations) and Section 149 of the Companies Act, 2013.

Having the right Board composition is essential for companies gearing up for an IPO. It ensures they meet regulatory requirements and avoid delays in the listing process. Regulations outline board structures, emphasizing a balanced mix of executive, non-executive, and independent directors. This balance helps in better decision-making, strengthens corporate governance, and boosts investor confidence. By following these guidelines, companies can create a Board that not only meets compliance standards but also provides strong and effective leadership.

We will take a look at the different scenarios of the composition of the board of directors as per the Regulation 17 of the LODR Regulations:

The board of directors of the top 2000 listed entities by way of market capitalization shall comprise of not less than six directors. The board of directors shall also have an optimum combination of executive and non-executive directors with at least one woman director (at least on woman independent director in case of top 1000 listed entities) and not less that fifty percent of the board of directors shall comprise of non-executive directors.

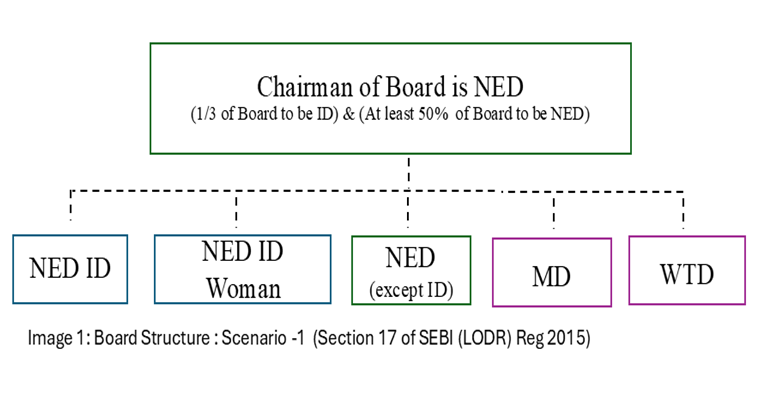

Scenario 1: where the chairperson of the board of directors is non-executive director, at least one third of the board of directors shall comprise of independent directors. So, the companies can form the board of directors as shown in figure below.

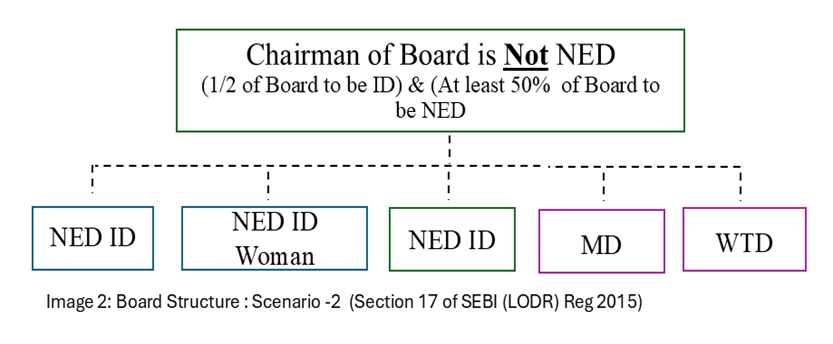

Scenario 2: Where the listed entity does not have a regular non-executive chairperson, at least half of the boardof the directors shall comprise of indpendent directors.

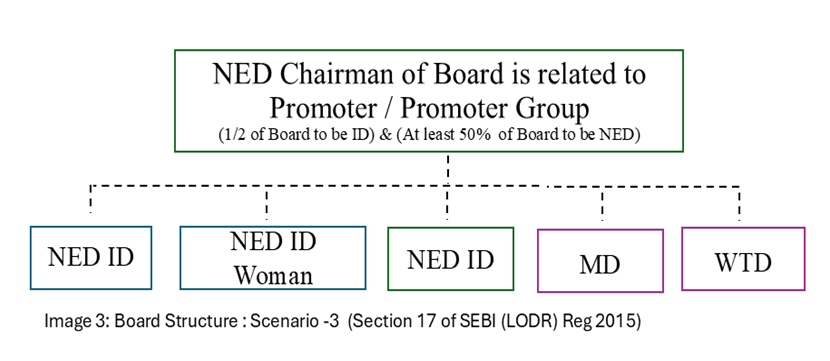

Scenario 3: if the regular non-executive chairperson is a promotor of the listed entity or is related to any promotor or person occypying management position at the level of board of directpr or at one level below the board of directors, at least half of the board of directors of the listed entity shall consist of indepenent directors

These are just the scenarios as per the Regulation 17 of the SEBI LODR Regulations considering minimum number of directors in the board of directors. Companies may need to curate the structure as per their requirements.

LODR further states the maximum number of the directorship allowed for a director. A person shall not be director in more than seven listed entities. Notwithstanding with this any person who is serving as a whole-time director or managing director of the listed entity shall not serve as independent director in not more than three listed entities.

Constitution of Nomination and Remuneration Committee (NRC)

NRC is constituted comprising of NEDs. Atleast two thirds of directors should be independent directors and the committee should have three members under the chairmanship of Independent Director.

As per Regulation 19 of SEBI (LODR) Regulations, 2015, every listed company must have an NRC to oversee the selection and remuneration of directors and senior management. Additionally, Section 178 of the Companies Act, 2013, mandates that the NRC define the qualifications, skills, and attributes required for these roles. By setting clear criteria, the NRC ensures that leadership positions are filled by individuals with the right expertise, integrity, and strategic outlook. It also establishes fair, performance-linked compensation, aligning leadership incentives with the company’s growth and shareholder interests.

Independent Director Requirements

As per Section 149(11) of companies act, 2013 and independent director can serve only two consecutive terms and can be reappointed after a cooling off period of 3 years. As company proceeds for IPO it is important to check the if the term of an independent director is coming to an end as soon as planned listing date, if so, company needs to appoint another independent director chosen by the NRC.

Directors Crossing the age of 75 years

Companies preparing for an IPO should also review the age limit of their directors. If any director is nearing 75 years as soon as company lists or in one years’ time after listing, shareholder approval must be obtained either before the director crossing the age of 75 years, ensuring compliance with regulatory requirements.

Reviewing Director Appointments Before IPO

For companies preparing to go public, it is essential to review the appointment of any nominee directors designated by institutions. Key checks include identifying which institution has nominated the director and whether the necessary member approval under the Companies Act has been obtained. If approval has not been taken, companies must assess whether it will be required post-listing under SEBI (LODR) regulations to ensure compliance and avoid governance issues after going public.

According to Schedule V, Part A, Para C, clause 10(h) of SEBI LODR Regulations certificate from company secretary in practice should be obtained that none of the directors on the board have been debarred or disqualified from being appointed as directors of companies by SEBI or Ministry of Corporate Affairs or any such statutory authority.

Case Study: Shadowfax (Feb 14, 2025)

Shadowfax- India’s premier provider of e-commerce express parcel and value-added solutions[1]– prepares for its IPO, the company has strengthened its board[2] by bringing in experienced independent directors. These leaders, with backgrounds in retail, venture capital, and logistics, are set to play a key role in guiding Shadowfax’s growth and ensuring strong governance.

This thoughtful decision reflects the company’s dedication to transparency, operational excellence, and long-term success. For other companies eyeing an IPO, taking similar steps can make a real difference—building investor trust, staying ahead of regulatory requirements, and laying the groundwork for a successful public debut. By adding the right experts to the board, companies can unlock new opportunities for growth and enhance their reputation in the market.

Conclusion

From the outset, we’ve highlighted the importance of companies fully complying with regulations when preparing for an IPO. One of the key factors in this process is the composition of the board of directors. Companies must ensure their directors meet eligibility criteria and, when necessary, obtain shareholder approval. This thoughtful approach not only streamlines the IPO process but also minimizes the risk of compliance issues post-listing. A well-structured board, supported by a Nomination and Remuneration Committee (NRC), is essential in shaping leadership, maintaining governance, and fostering investor trust. By proactively addressing regulatory aspects such as director age limits and board composition requirements, companies can avoid hurdles and set the stage for a smoother IPO, long-term growth, and sustained market credibility.

Here are some key action points that companies should implement to ensure compliance.

- Ensure Proper Board Composition – Maintain the right mix of executive, non-executive, and independent directors, including a woman director, as per Regulation 17 of SEBI (LODR). It also needs to ensure that it has minimum no. of directors as specified under SEBI LODR.

- Meet Independent Director Criteria – Ensure compliance with Section 149 of the Companies Act, 2013, including ensuring compliance with terms of independent directors and cooling-off periods for re-appointment of independent directors.

- Composition of Committees: Ensure that statutory committees are properly constituted viz. audit committee, nomination and remuneration committee, stakeholder relationship committee etc. It also needs to be ensured that these committees are properly constituted as per the requirements stated in SEBI (LODR) regulations and Companies act, 2013.

- Review Director Age Limits – Obtain shareholder approval for directors nearing 75 years of age before in accordance with provisions of SEBI LODR.

- Ensure Directorship Compliance – No director should hold directorships in more than seven listed entities (or three if a whole-time director/MD serving as an independent director).

- Obtain Compliance Certification – Get a practicing company secretary’s certificate confirming all directors meet eligibility criteria and are not debarred by SEBI or MCA or any other applicable regulatory authority.

By taking these steps before filing the DRHP, companies can avoid compliance risks and ensure a smooth IPO process and long-term success.

[1] https://www.entrepreneur.com/en-in/news-and-trends/shadowfax-strengthens-board-with-strategic-appointments-of/486609

[2] https://inc42.com/buzz/shadowfax-strengthens-its-board-ahead-of-ipo/

This article has been published on Taxmann. The link for the same