Listing Obligations and Disclosure Requirements (LODR), 2015: Enhancing Transparency and Disclosure in Corporate Affairs

A. Introduction:

On June 14, 2023, the markets regulator notified the SEBI (Listing Obligations and Disclosure Requirements) (Second Amendment) Regulations, 2023 (“LODR”). These amendments are in tandem with the consultation papers that were formerly released by SEBI. The objective of these amendments is to reinforce and bolster corporate governance at listed entities by enabling shareholders, streamlining the disclosure requirements for material events or information, and enhancing the compliance. These also intend to signify the regulator’s commitment in promoting authenticity, commitment, and investor confidence in India’s capital markets.

B. Amendment in LODR and deliberations:

Most of the amendments shall come into force from July 14, 2023 (i.e., from the thirtieth day from the date of publication in Official Gazette). This amendment significantly includes the following: –

- Notifying materiality thresholds for determination of material information for disclosure to stock exchanges under Para B of Part A of Schedule III read with regulation 30.

- Mandatory requirement of filling vacancy of KMPs within 3 months,

- Initiation of threshold-based parameters for identifying the materiality of events/ information existing as on the date of notification of this amendment

- Introduction of Non-Permanency Concept (No permanent seat for any director on the Board of Directors)

- Mandatory Disclosure Requirement of Certain Agreements

Following is the brief of the amendments in this notification are as follows: –

1. Stricter timeline to fill the Vacancy of the Compliance Officer and Key Managerial Personnel (KMP) within 3 months from the date of the vacancy:

Regulation 6(1) – LODR requires a listed entity to appoint a Qualified Company Secretary as the Compliance Officer. SEBI has now stated that any vacancy in the office of the Compliance Officer shall be filled by the listed entity at the earliest and in any case not later than 3 months from the date of such vacancy.

Further, SEBI also inserted a new regulation 26A which states that any vacancy in the office of the Chief Executive Officer, Chief Financial Officer, Managing Director, Whole Time Director, or Manager must be filled by the listed entity at the earliest and in any case not later than three months from the date of such vacancy.

SEBI has further stated that listed entity shall fill vacancy in the office of Compliance Officer and KMP by appointing a person in interim capacity, but such appointment shall be made in accordance with the laws applicable in case of a fresh appointment to such office and the obligations under such laws are made applicable to such person.

On resignation of key managerial personnel, senior management, Compliance Officer, or director other than an independent director, detailed reasons of resignation alongwith resignation letter needs to be submitted to stock exchange within seven days of resignation coming into effect. Similar provision for independent director was already in existence for independent directors and auditors.

2. No Director can be permanently on the board of a listed entity:

Regulation 17(1D) (newly introduced) specifies that from April 1, 2024, the continuation of a directors serving on the board of directors of a listed entity shall be subject to the approval by the shareholders in a general meeting at least once in every 5 years from the date of their appointment or reappointment, as the case may be. Further, the directors serving on the board of listed entity as on March 31, 2024, without the approval of the shareholders for the last 5 years or more shall be subject to the approval of shareholders in the first general meeting which is to be held after March 31, 2024.

3. Introduction of threshold-based criteria for determining the materiality of events/information:

Regulation 30(1) – LODR prescribes that “Every listed entity shall make disclosures of any events or information which, in the opinion of the board of directors of the listed company, is material.” Further, Regulation 30(4) specifies the criteria for determining the materiality of events/information. Initially, there was no threshold-based criteria for identifying the materiality of the events/information. SEBI had vide its consultation paper dt: November 12, 2022, had proposed certain thresholds for determining material criteria.

After market consultation SEBI has now introduced threshold-based criteria for determining the materiality of an event/information. This threshold criteria was first proposed based on standalone financials. But after market consultation SEBI has now prescribed it based on consolidated financials.

Accordingly, following new quantitative thresholds have been added that the omission of an event or information, whose value, or the expected impact in terms of value, exceeding the lower of the following: –

- 2% of turnover, as per the last audited consolidated financial statements of the listed entity.

- 2% of net worth, as per the last audited consolidated financial statements of the listed entity, except in case the arithmetic value of the net worth is negative.

- 5% of the average of the absolute value of profit or loss after tax, as per the last three audited consolidated financial statements of the listed entity.

A new proviso further has been added which states that policy for determination of materiality shall not dilute any requirement specified under the provisions of these regulations. Also, such a policy for the determining materiality shall help relevant employees of listed entity in identifying any material event or information and intimating the same to the authorized KMP.

4. SEBI specifies shorter timelines for the disclosure of material events/information:

SEBI has now prescribed timelines for disclosures of events or information based on origin of event or information. The time limits specified for disclosures based on materiality of information (i.e., Para B of Part A of Schedule III) is as follows –

- Within 30 minutes from the closure of the meeting of the board of directors in which the decision pertaining to the event or information has been taken.

- Within 12 hours from the occurrence of the event or information if it emanates from within the listed entity.

- Within 24 hours from the occurrence of the event or information if it does not emanate from within the listed entity.

The time limits specified for disclosures which are deemed to be material (i.e., Para A of Part A of Schedule III) and other disclosures under Schedule III is not changed.

5. Compulsory disclosure of details w.r.t cybersecurity incidents, breaches, or loss of data along with quarterly compliance report:

A new sub-regulation (ba) has been inserted in regulation 27 which prescribes mandatory disclosure of details regarding cyber security incidents or breaches or loss of data or documents in quarterly compliance report.

6. Verification of market rumors:

A new proviso has been inserted which states that the top 100 listed entities (with effect from October 1, 2023) and subsequently the top 250 listed entities (with effect from April 1, 2024) are required to promptly confirm, deny, or provide any clarification regarding reported events or information in the “mainstream media”. Further, the entities are expected to fulfill and meet this obligation as soon as possible, within a maximum timeframe of 24 hours from the reporting of the event or information.

Meaning – Mainstream Media – SEBI inserted a new clause ‘ra’ in regulation 2. Regulation 2(ra) defines the term “Mainstream Media”. The same shall include print or electronic mode of the following:

- Newspapers registered with the Registrar of Newspapers for India

- News channels permitted by the Ministry of Information and Broadcasting under the Government of India

- Content published by the publisher of news and current affairs content as defined under the Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021; and

- Newspapers or news channels or news and current affairs content similarly registered or permitted or regulated in jurisdictions outside India.

7. Revised timelines regarding intimation to Stock Exchanges:

Listed entity shall now be required to submit a certificate to stock exchange regarding status of payment of interest or dividend or repayment or redemption of principal of nonconvertible securities, within 1 working day of it becoming due in manner and format as specified from time to time.

8. Dissemination of information on website at least 2 days in advance regarding Institutional Investors meet:

The sub-para 15 of Para A requires disclosure of schedule of analysts or institutional investors’ meet. This disclosure is required to be made prior to the investors’ meet. Earlier any fixed time schedule for prior intimation was not prescribed.

As per the amendment, the listed entities shall now be required to disclose under a separate section on their website; schedule of analysts or institutional investors meet at least 2 working days in advance (excluding the date of the intimation and the date of the meet) and presentations made by the listed entity to analysts or institutional investors.

9. Sale, Lease or Disposal of an undertaking outside Scheme of Arrangement:

Listed entity carrying out sale, lease or otherwise disposal of the whole or substantially the whole of the undertaking of such entity or where it owns more than one undertaking, of the whole or substantially the whole of any of such undertakings, shall –

- Take prior approval of shareholders by way of special resolution,

- Disclose the object and commercial rationale for carrying out such sale, lease or otherwise disposal of the whole or substantially the whole of the undertaking of the entity, and the use of proceeds arising therefrom, in the statement annexed to the notice to be sent to the shareholders.

The special resolution shall be acted upon only if the votes cast by the public shareholders is in favour of resolution exceeds the votes cast by such public shareholders against the resolution. No public shareholder shall vote on the resolution if he is a party, directly or indirectly, to such sale, lease or otherwise disposal of the whole or substantially the whole of the undertaking of the listed entity. The approval mentioned above will not be applicable for sale, lease or otherwise disposal of whole or substantially the whole of undertaking to a wholly owned subsidiary whose accounts are consolidated. Approval shall be required if the wholly owned subsidiary further sells, leases, or disposes of whole or substantially the whole of undertaking. If the listed entity tries to reduce the stake in wholly owned subsidiary, then it would further require approval from the members of the company.

10. Disclosure requirements for certain types of agreements binding listed entities:

SEBI inserted a new Regulation 30A that requires all the shareholders, promoters, promoter group entities, related parties, directors, key managerial personnel and employees of a listed entity or of its holding, subsidiary and associate company, who are parties to agreements specified, to inform the listed entity about the agreement to which such a listed entity is not a party, within 2 working days of entering into such agreements or signing an agreement.

Further, the agreements that are subsisting as on the date of notification of the present amendment, the parties to the agreements shall inform the listed entity, about the agreement to which such a listed entity is not a party and the listed entity shall in turn disclose all such subsisting agreements to the Stock Exchanges and on its website within the timelines as specified.

The listed entity shall also disclose the number of agreements that subsist as on the date of notification of the present amendment, their features, including the link to the webpage where the complete details of such agreements are available, in the Annual Report.

Specified Agreements – A new clause 5A of para-A of part A of Schedule III of the LODR Regulations has been notified. The Agreements specified for the applicability:

Agreements entered into by the shareholders, promoters, promoter group entities, related parties, directors, key managerial personnel, employees of the listed entity or of its holding, subsidiary, or associate company, among themselves or with the listed entity or with a third party, solely or jointly, whose purpose and effect is to impact the management or control of the listed entity or impose any restriction or create any liability. Further SEBI has also mandated disclosure of these agreements in annual reports of listed entities.

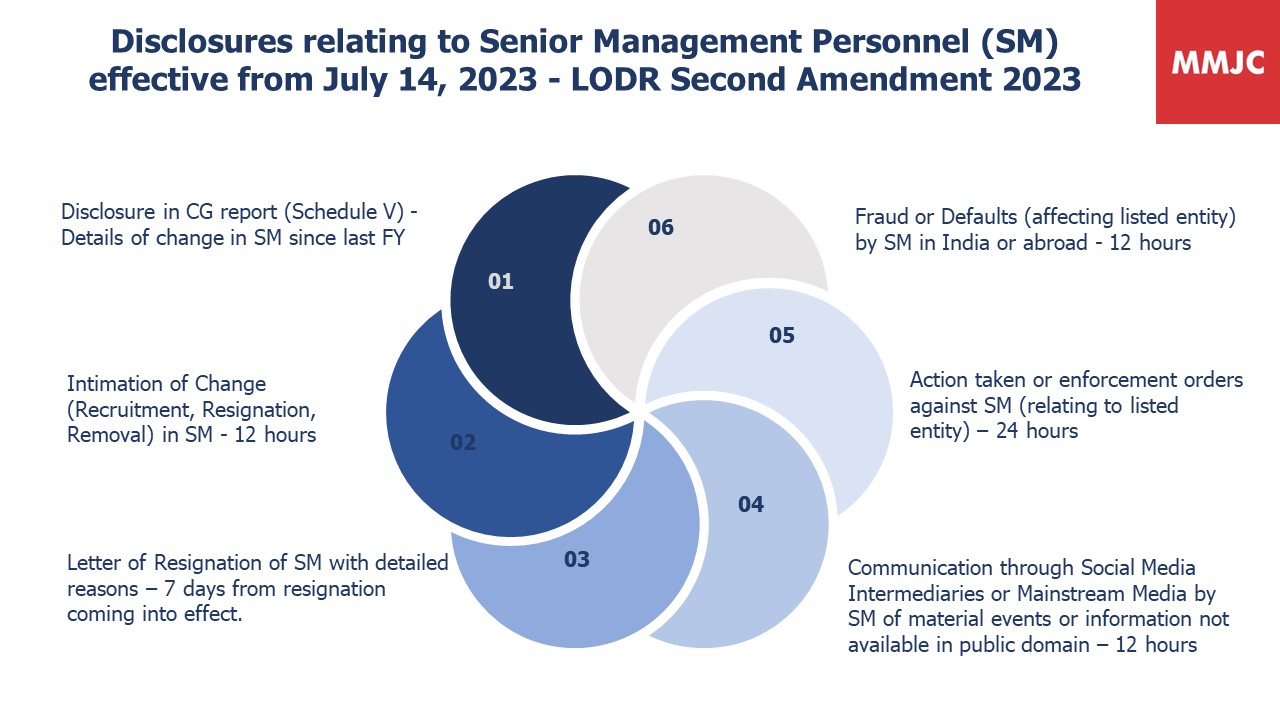

11. SEBI has now mandated additional disclosures pertaining to change in senior management:

12. SEBI has notified additional disclosures under Schedule III Part A, Para A. Some of the important disclosures are as follows:

- Intimation of sale of whole or substantially the whole of undertaking

- an agreement to sell or sale of shares or voting rights in a company such that the company ceases to be a wholly owned subsidiary, a subsidiary, or an associate company of the listed entity.

- an agreement to sell or sale of shares or voting rights in a subsidiary or associate company such that the amount of the sale exceeds the threshold specified in subclause (c) of clause (i) of sub-regulation (4) of regulation 30.

- disclosure of new ratings as against revision in ratings

- Disclosure of frauds and defaults disclosure is now extended to senior management and subsidiary companies. Further disclosure of arrest is also extended to senior management. Further SEBI has defined the terms ‘fraud’ and ‘defaults.

- Disclosure of situation where Managing Director or Chief Executive Officer is not available or is indisposed to fulfil requirements of role in a regular manner for 45 days in a rolling period of ninety days.

- Announcement or communication through social media intermediaries or mainstream media of material events not already disclosed by directors, promoters, key managerial personnel, or senior management.

- Action taken or orders passed by various regulatory authorities against the listed entity or its directors, key managerial personnel, senior management, promoter, or subsidiary, in relation to the listed entity.

- Further SEBI has also enhanced disclosures requirements with respect to material events as per Para B, Part A of Schedule III.

13. Extension on the applicability of Chapter IV on ‘high value debt listed entity’ on a ‘comply or explain’ basis:

Chapter IV states the Obligations of Listed Entity which has listed its specified securities and nonconvertible debt securities. Initially the provisions of chapter IV were applicable to high value debt listed entity on comply or explain basis until March 31, 2023.

Presently, the same stands extended by one more financial year i.e., uptil March 31, 2024. Thereafter, the Chapter IV shall be mandatorily applicable.

C. Conclusion

The newly introduced reforms by SEBI demonstrate a strong commitment to bolstering investor confidence and establishing a robust regulatory framework within India’s capital markets. By addressing vital elements of corporate governance, SEBI aims to cultivate an environment that promotes sustainable growth and upholds fair practices. These transformative changes will have a positive impact on the functioning and integrity of listed entities, benefiting stakeholders and contributing to the overall health of the economy. With a focus on empowering transparency, accountability, and investor protection, SEBI’s reforms pave the way for a more resilient and responsible financial ecosystem in India. By fostering trust and instilling best practices, SEBI sets the stage for increased participation, growth, and long-term prosperity in the capital markets.