Introduction

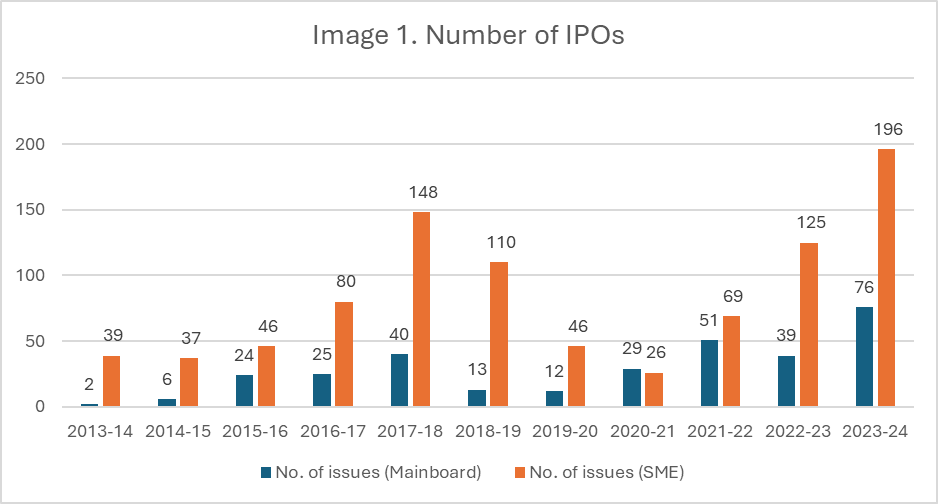

India’s capital market is experiencing robust growth, with an increasing number of companies successfully raising funds to drive exponential growth. Exhibit A (Image 1) illustrates a consistent year-on-year rise in both Mainboard and Small and Medium Enterprise (SME) IPOs. The dip in IPO activity during 2019-2020 can be attributed to the COVID-19 pandemic. This surge highlights positive market sentiment and the Indian market’s ability to attract investors.

After listing, companies bear the responsibility of ensuring their shareholders receive good returns on their investments. According to data from the BSE, of the 692 companies listed on the Mainboard and SME[1] platforms, 528 provided listing gains, while 163 experienced negative listing gains. However, an analysis by Economic Times Intelligence Group (ETIG) of Mainboard IPOs since early 2020 revealed that half of the companies with listing gains exceeding 50% struggled to sustain those gains over time[2]. This highlights the importance of accurately valuing an IPO. This article explains how companies can decide the right value for their business when planning an IPO. It focuses on balancing fundraising goals with keeping stock prices attractive to avoid a drop after listing, helping businesses grow steadily and gain investor trust.

Exhibit A: year-on-year rise in Mainboard and SME IPOs

Factors affecting Success of an IPO

The success of an IPO depends on several factors, including company valuation, market conditions, investor sentiment, financial performance, the strength of the management team, regulatory compliance, and effective public relations. However, in this discussion, we will focus specifically on how company valuation and the fair pricing of shares impact the success of an IPO. We will explore how different companies approach the valuation process during their IPO and the role that setting a fair and accurate share price plays in attracting investors and ensuring long-term success.

Valuation is key to success of an IPO.

‘A successful IPO means your stock price goes down,’ this is the view of Mr. Richard Keiser, Founder and CEO of Common Energy. Earlier this was the most common view of all the companies going for an IPO. When a company goes for IPO, the aim of the company is to raise money from the capital market.

Getting the valuation right is key to launching a successful IPO. A fair IPO price helps the company raise enough funds while offering attractive returns to investors. These returns come in two forms: listing gains, which draw immediate interest, and long-term growth, reflecting the company’s performance over time. For many investors, listing gains are particularly attractive, as they often view strong listing performance as a measure of an IPO’s success. Proper pricing strikes a balance between attracting investors and maintaining the company’s value in the long run, ensuring a successful and profitable IPO. That means company should sell its stock at highest price it can sell. This will ensure that company should grab all its valuation from the market as company cannot issue shares in the future without putting downward pressure on the stock price[1].

Drawbacks of Overvaluation

Overvaluation during an IPO might seem attractive to companies as it allows them to raise the maximum possible funds. However, such an approach carries inherent risks:

- The Risk of Excessive Fundraising:

Companies that secure more funds than they can efficiently utilize often struggle to justify their valuations. This can result in idle capital or suboptimal allocation, eroding investor trust and leading to significant post-listing price corrections.

- Impact of Maximized Valuations on Investor Returns:

When IPO valuations are pushed to their limits, shareholders have minimal room for post-listing profits. This reduces the IPO’s appeal and risks fostering long-term distrust among retail and institutional investors, affecting future market confidence.

- Limiting Future Fundraising:

If a company maximizes its valuation during the IPO, it risks exhausting its potential for future capital raises. Any subsequent issuance of shares is likely to put downward pressure on the stock price, creating a barrier to further fundraising.

A Balanced Approach to IPO Valuation

The power with which to acquire whatever one demands of life without violating the rights of others[2] ; which can only be achieved by taking a balanced approach toward the IPO valuation which will also ensure long-term success and shareholder satisfaction. Companies may take into consideration the following points while valuation:

- Raise Only What is Needed:

Companies should assess their actual funding requirements based on realistic growth plans. Raising excessive funds without immediate use leads to inefficiency and reduces shareholder returns.

- Leave Room for Shareholders:

By setting a reasonable valuation, companies can allow for post-listing price appreciation, giving shareholders a margin to earn profits. This builds goodwill and strengthens long-term investor relationships.

- Preserve Future Valuation Potential:

Companies should avoid exhausting their valuation potential during the IPO. A prudent approach ensures room for future fundraising at attractive valuations without adversely impacting stock prices.

- Align Valuation with Market Perceptions:

IPO pricing should reflect the company’s financial performance, growth potential, and market sentiment. Overstretched valuations can lead to immediate corrections, eroding investor trust.

Lessons from the Market

The Indian market has seen numerous IPOs, each offering valuable lessons in balancing valuation, fund utilization, and shareholder returns. The following case studies illustrate how varying approaches to IPO valuation impact performance post-listing.

- Paytm (2021):

An example of a company that listed at a discount and struggled post-listing is Paytm (One97 Communications). Paytm, a well-known fintech player, went public in November 2021 during a period of bullish market sentiment. With a price band of ₹2,080–₹2,150 per share and an issue size of ₹18,300 crores, it was one of India’s largest IPOs. However, the company listed at a discount and never reached its IPO price. Since its debut, Paytm’s stock has declined by about 59%, marking it as one of the most underperforming IPOs in recent years. Analysts attribute this to its overvaluation and lack of a clear profitability pathway[3]

- Zomato (2021):

A Case of Overvaluation Zomato’s IPO in 2021 exemplified the risks of overvaluation driven by market euphoria. With a high Price-to-Sales (P/S) ratio and an issue price of ₹72–76 per share, Zomato raised ₹9,375 crores, achieving a valuation of ₹1 lakh crore. While the IPO saw strong listing gains of 66%, it faltered due to concerns about profitability, unsustainable cash burn, and macroeconomic pressures like rising interest rates. This underscores the importance of aligning valuations with realistic growth prospects and efficient fund utilization to maintain investor confidence.[4]

- HDFC AMC (2018):

A Prudent Valuation Approach HDFC AMC’s IPO in 2018 displayed the benefits of a balanced and sustainable strategy. Priced at ₹1,095–1,100 per share, the IPO raised ₹2,800 crores, with valuations aligned to industry peers. Supported by consistent profitability, operational efficiency, and a clear fund utilization plan, the IPO attracted strong demand, with 83 times oversubscription. Listing at a 65% premium, HDFC AMC has since delivered steady returns due to efficient fund use, stable growth, and the trusted HDFC brand. This highlights how conservative valuations and strategic fund allocation build long-term investor trust and sustainable market performance.[5]

Conclusion:

A well-balanced IPO valuation is critical for maintaining investor confidence and ensuring sustainable growth. By raising only necessary funds and allowing room for post-listing gains, companies can build long-term trust and create value for all stakeholders.

[1] https://www.bseindia.com/publicissue.html

[2] https://timesofindia.indiatimes.com/business/india-business/top-gainers-since-2020-which-ipos-have-managed-to-sustain-their-listing-gains/articleshow/114003949.cms

[3] https://medium.com/swlh/a-successful-ipo-means-your-stock-price-goes-down-fd3c1aa53f00

[4] https://www.soundwisdom.com/blog/how-do-you-define-success-an-exclusive-excerpt-from-napoleon-hills-think-your-way-to-wealth

[6] DRHP of Zomato, https://www.nseindia.com/get-quotes/equity?symbol=ZOMATO

[7] https://www.livemint.com/Money/Heuv9XnDyZSvLwmoXAikMP/HDFC-AMC-IPO-Listing-allotment-date-share-price-brokerag.html

This article has been published on Taxmann.