SEBI vide circular dated 31 December 2024[1] notified the framework for integrated filing. Integrated filing as a concept was notified by SEBI vide its Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) (Third Amendment) Regulations, 2024 amendment notification dated 12 December, 2024[2]. Pursuant to this Bombay Stock Exchange and National Stock Exchange [Stock exchanges’] vide its circular dated 2 January 2025[3] provided for details of integrated filing to be done on stock exchange. Integrated filing is divided into two segments:

- Integrated Filing Governance

- Intergraded Filing Financials

Integrated Filing Governance:

Q1. What all compliances are incorporated under ‘Integrated Filing (Governance)’?

Integrated filing (Governance) comprises of five periodic filings which are as follows:

- Corporate Governance Report (‘CGR’)

- Investor Grievance Report (‘IGR’)

- Disclosure of acquisitions of shares or voting rights in unlisted Companies

- Disclosure of updates on tax litigations or disputes

- Disclosure of imposition of fine or penalty.

Q2. CGR and IGR are available in XBRL utilities so whether XBRL utilities of CG and IGR are to be filed? If yes, within what time?

Yes, XBRL utilities of CGR and IGR are to be filed. Even if they are integrated filing governance individual XBRL utilities are to be filed. These utilities are to be filed within 30 days (i.e. by 30 January 2025).Yes, XBRL utilities of CGR and IGR are to be filed. Even if they are integrated filing governance individual XBRL utilities are to be filed. These utilities are to be filed within 45 days (i.e. by 14 February 2025).Yes, XBRL utilities of CGR and IGR are to be filed. Even if they are integrated filing governance individual XBRL utilities are to be filed. These utilities are to be filed within 30 days (i.e. by 30 January 2025).

Q3. What is the time limit for filing Integrated filing (governance) and it is to be filed within in what format?

Integrated Filing (Governance) is to be filed within 30 days from the end of the quarter. For the quarter ended 31 December 2024 Stock exchanges have allowed listed companies to file Integrated Filing (Governance) withing 45 days from the end of the quarter (i.e. by February 14, 2025). Integrated filing (Governance) is to be filed in XBRL utility[1].

Q4. Is Integrated Filing Governance required to be filed in addition to individual XBRL utilities?

Yes. Integrated filing (Governance) in XBRL utility is required to be filed in addition to CGR and IGR XBRL utilities being filed. Integrated Filing (Governance) would comprise of additional disclosures relating to acquisitions of shares or voting rights by listed companies in unlisted companies, disclosure of updates on tax litigations or disputes, and disclosure of imposition of fine or penalty.

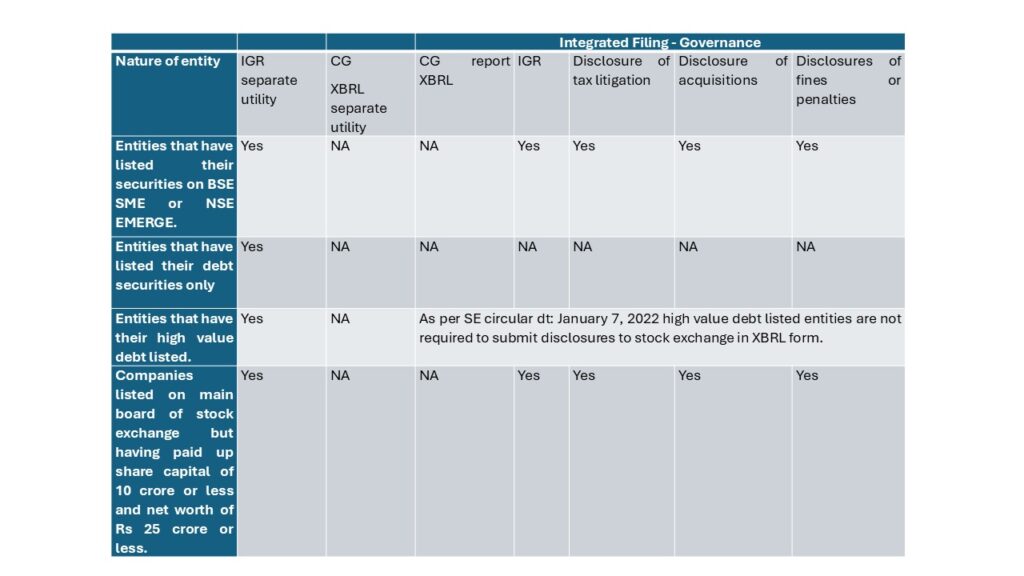

Q5. Are following companies required to comply with integrated filing (Governance) norms:

- Entities that have listed their debt securities only?

- Entities that have listed their securities on BSE SME or NSE EMERGE?

- Entities that have their high value debt securities listed?

- Companies listed on main board of stock exchange but having paid up share capital of 10 crore or less and net worth of Rs 25 crore or less?

Note: Clarity on applicability of integrated filing (governance) for above category of listed entities is awaited from stock exchanges. Taking a conservative companies may ensure compliance as specified above.

Q6. Listed Companies are receiving mails from Stock Exchanges to file ‘IGR and CG within 21 days from the end of quarter?

Stock exchanges send reminder mails to listed entities for doing quarterly filings after the end of every quarter. These mails are pursuant to provisions prior to amendment to SEBI (LODR). With revised timelines and formats now notified by Stock exchanges vide their circular dt: 2 January 2025 quarterly compliances are now required to be done in accordance with that.

[1] https://www.sebi.gov.in/legal/circulars/dec-2024/circular-for-implementation-of-recommendations-of-the-expert-committee-for-facilitating-ease-of-doing-business-for-listed-entities_90406.html

[2] https://www.sebi.gov.in/legal/regulations/dec-2024/securities-and-exchange-board-of-india-listing-obligations-and-disclosure-requirements-third-amendment-regulations-2024_89956.html

[3] https://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20250102-4 and https://nsearchives.nseindia.com/web/sites/default/files/inline-files/NSE%20Circular%20facilitating%20ease%20of%20doing%20business%20for%20listed%20entities-%20Integrated%20Filing.pdf