Introduction

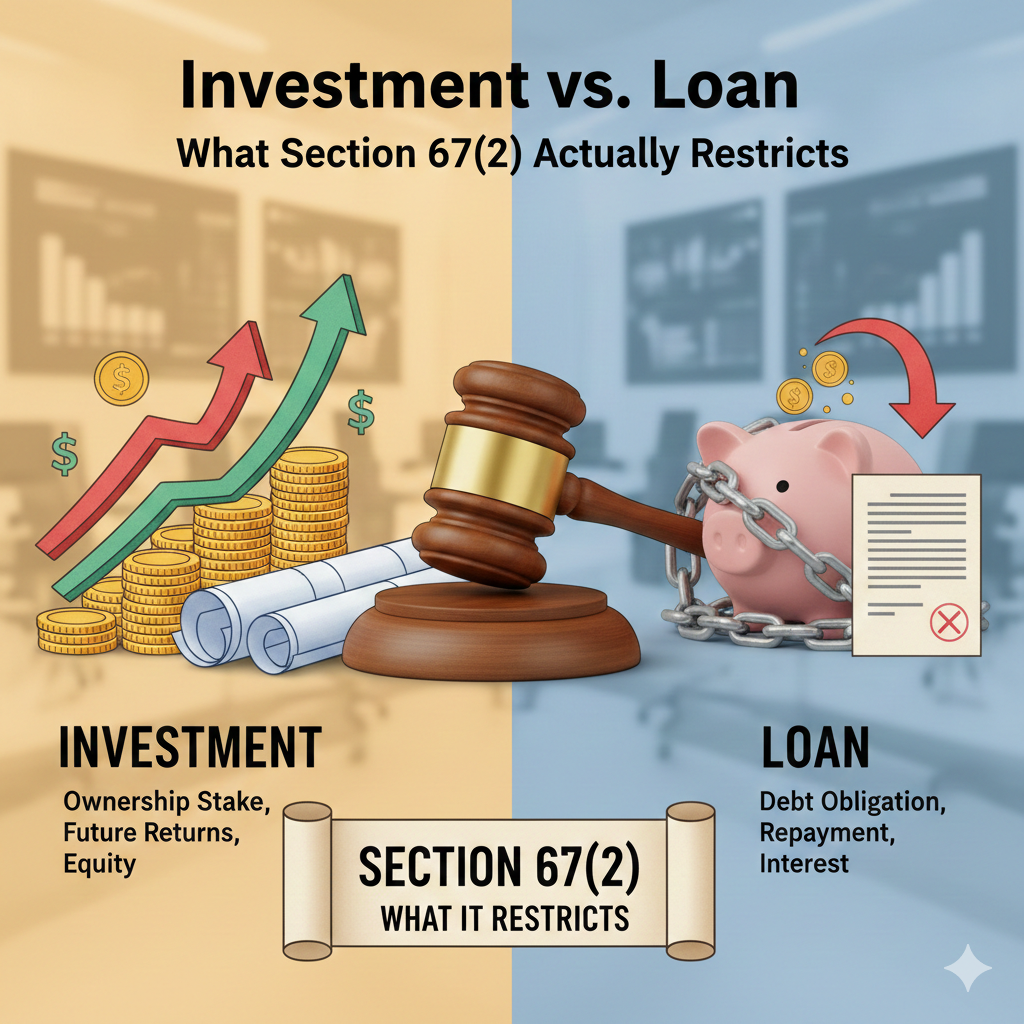

Sub-section (2)[i] of section 67 prohibits a public company other then a IFSC company from giving any financial assistance in the nature of loan, guaranty, security or otherwise to any person for buying shares of itself or its holding company. due to use of phrase “or otherwise”, the first glance of this sub-section gives an impression that, the sub-section prohibits grant of loans as well as making of investments. However, it is not so straight forward, and needs careful interpretation of sub-section 2.

In this article, we shall try to deliberate upon this question that, whether sub-section (2) prohibits only grant of loan/guaranty/security , or it prohibits giving of any kind of finance? In other words, can the words “or otherwise” used in said sub-section be interpreted so as to include investments therein? For example, is ABC ltd (an Indian unlisted public company), prohibited only from giving loan, guaranty or security to any person who intends to invest the same amount in the shares of ABC ltd, or it is also prohibited from making investment in any such person who may possibly invest in ABC ltd?

Analysis of Bare provision.

Simple reading of the language of sub-section (2) reveals that it only prohibits giving of loan/guaranty/security to any person for purchase of its own shares or that of its holding company. however, the use of phrase “or otherwise” after the words loan/guaranty/security in the provision, gives rise to an open ended question that, can this phrase “or otherwise” include making of investment?

Assistance from heading of the section.

In order to find an answer to this question, help can be taken from the heading of the section 67, which reads as, “Restrictions on Purchase by Company or Giving of Loans by it for Purchase of its Shares”. As per the rules of interpretation, Heading in a particular section lends, though not normally a part of the statutory provision, assistance in interpreting the statutory intent since the ‘heading’ always serves as a guide to depict the intention. It also makes it clear that the marginal note to a section cannot be referred to for the purpose of construing the section but it can certainly be relied upon as indicating the drift of the section. It also shows that the heading/marginal notes prima facie furnish some clue as to the meaning and purpose of the section[ii].

The heading of the section 67 clearly talks about restriction on giving of loan and not on making of investments. Therefore as per the above discussion, in can be inferred that the section intends to regulate grant of loan and not making of investments.

Applying ejusdem generis to “or otherwise”

In order to understand whether or not the words “or otherwise” can be interpreted to include investment therein, the interpretation principle of “ejusdem generis” can be applied. This principle is defined in the Black’s Law Dictionary, 9th Edn. as follows:

“A canon of construction holding that when a general word or phrase follows a list of specifics, the general word or phrase will be interpreted to include only items of the same class as those listed.”

Further, the honorable NCLT Kolkata bench in its order in the matter of capital reduction of MODERN HI-RISE PRIVATE LIMITED[iii], has explained the manner of applying ejusdem generis in following words

“ejusdem generis (Latin for “of the same kind”) is a fundamental rule of statutory interpretation. It dictates that when general words in a statute follow a list of specific words, the meaning of those general words is confined to the same class or category established by the specific words. The purpose is to ensure that legislative intent is upheld by giving effect to every word in a statute, preventing general terms from being interpreted in a way that is overly broad or inconsistent with the specific terms. For the doctrine to be applicable, several conditions must be met: The statute must contain an enumeration of specific words. The enumerated words must constitute a distinct class or genus. General words must follow the specific enumeration. There must be no contrary legislative intent.”

if we apply the conditions enumerated by NCLT to section 67(2), we observe that, the provision in question does enumerate a specific list of words which include, loans, guaranty and providing of security. All these specific words constitute a separate class or genus as they all relate to act of lending funds in some or the other manner. Further the general words of “or otherwise” also follow the specific words of loan, guaranty, security. Also, it prima facie does not appear that there was a legislative intend to regulate investments under section 67(2). This is for the reason that, the provision does not expressly say so

therefore, it can be said that, the words “or otherwise” can be interpreted by applying interpretation principle of ejusdem generis. As per this principle, the general words that is, “or otherwise” have to be red in the context of specific words that is, “loan, guaranty or providing of security”. Hence the words “or otherwise” can be interpreted to cover all types of direct or indirect loan transactions but may not be extended to cover investment.

Conclusion.

This provision of section 67 originally originates from English law and is based on the principle that, the capital of the company should be protected for the benefit of the creditors of the company. keeping this intent in mind, prohibition on grant of loan sounds logical as it may result in siphoning of funds of company. however, such siphoning of funds is difficult in case of investment and therefore the section does not restrict the same.

[i] (2) No public company shall give, whether directly or indirectly and whether by means of a loan, guarantee, the provision of security or otherwise, any financial assistance for the purpose of, or in connection with, a purchase or subscription made or to be made, by any person of or for any shares in the company or in its holding company.

[ii] Brihan Mumbai Electric Supply Transport Undertaking & Another v. Laqshya Media P. Ltd. 2009 AIR SCW 7528

[iii] reduction of capital of MODERN HI-RISE PRIVATE LIMITED, NCLT Kolkata bench, order dated 9th September 2025.

This article is published on Taxmann. (Link to Taxmann Source)