A. Background

1. The Securities and Exchange Board of India (SEBI), in coordination with the Industry Standards Forum (comprising ASSOCHAM, CII, and FICCI), had issued a circular dated June 26, 2025, prescribing Industry Standards on “Minimum Information to be provided to the Audit Committee and Shareholders for approval of Related Party Transaction (RPT)”.

2. Industry standards on RPT substituted Para 4 under Part A of Section III-B and Para 6 under Part B of Section III-B of the Master Circular dated November 11, 2024.

3. Now, SEBI, vide Circular No. SEBI/HO/CFD/CFD-PoD-2/P/CIR/2025/135 dated October 13, 2025 (“said Circular”), further amended Section III-B of the Master Circular and Paragraph 7 of the June 26, 2025 Circular, to introduce threshold-based relaxation in furnishing minimum information by substituting the corresponding paragraphs under the relevant circulars as mentioned above.

4. The said circular shall be applicable with immediate effect.

5. The provisions shall not apply to the following categories of listed entities:

a. having only non-convertible securities listed or

b. High value debt listed entities or

c.listed entities having paid up equity share capital not exceeding Rupees 10 crore and net worth not exceeding rupees 25 crore (as on the last day of the previous financial year) or

d. listed entity on SME exchange (except where paid up equity share capital exceeding Rupees 10 crore and net worth exceeding rupees 25 crore).

B. Amendment

Threshold-based relaxation:

1. For any RPT (individually or cumulatively during the financial year, including ratified transactions):

If the value does not exceed 1% of annual consolidated turnover of the listed entity or ₹ 10 crore, whichever is lower, the entity shall furnish “Minimum Information” to the Audit Committee and Shareholders for approval of RPT in the format as specified in Annexure 13A to the said circular.

2. Exemption threshold of Rupees One Crore as specified in Para 3(c) of the RPT Industry Standards shall continue to apply.

3. Listed entities shall follow the format as prescribed in the said circular and RPT Industry Standards, as may be applicable, to ensure compliance with Part A and Part B of Section III-B of the Master Circular read with Regulation 23(2), (3) and (4) of LODR Regulations.

C. Impact of the amendment:

| If an RPT (individually or cumulatively during the financial year, including ratified transactions) | ||

| Scenario | Compliance Requirement | |

| Does not exceed an amount of Rupees 1 Cr | Exempt from the requirement | |

| Does not exceed 1% of annual consolidated turnover or Rupees 10 crore, whichever lower | Minimum information to the Audit Committee and Shareholders for approval of related party transactions’ specified in Annexure-13A of said circular. | |

| Exceeds an amount of 1% of annual consolidated turnover or Rupees 10 crore, whichever lower | Information as specified in the Industry Standards on “Minimum information to be provided to the Audit Committee and Shareholders for approval of Related Party Transactions” issued via circular dated June 26, 2025 | |

[Note: Annual consolidated turnover of the listed entity as per the last audited financial statements of the listed entity]

- Minimum Information shall be provided as per the said circular for approval of RPT only and not for review of any RPT in accordance with regulation 23(3) of LODR.

- Transaction with a related party whether individually or taken together with previous transactions during a financial year, i.e. from April 2025.

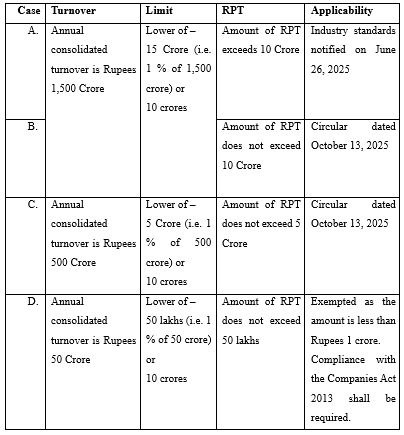

- In case of listed entities having annual consolidated turnover of Rupees 1,000 crores or more and the amount of related party transaction(s) is less than Rupees 10 crore, then such entities shall comply with provisions of said circular. [refer table below]

D. Minimum information to be provided as per Annexure 13A to the circular:

(A) To Audit Committee

a. Type, material terms and particulars of the proposed transaction;

b. Name of the related party and its relationship with the listed entity or its subsidiary, including nature of its concern or interest (financial or otherwise);

c. Tenure of the proposed transaction (particular tenure shall be specified);

d. Value of the proposed transaction;

e. The percentage of the listed entity’s annual consolidated turnover, for the immediately preceding financial year, that is represented by the value of the proposed transaction (and for a RPT involving a subsidiary, such percentage calculated on the basis of the subsidiary’s annual turnover on a standalone basis shall be additionally provided);

f. If the transaction relates to any loans, inter-corporate deposits, advances or investments made or given by the listed entity or its subsidiary:

i. details of the source of funds in connection with the proposed transaction;

ii. where any financial indebtedness is incurred to make or give loans, intercorporate deposits, advances or investments,

- nature of indebtedness;

- cost of funds; and

- tenure;

(Note: The requirement of disclosure in Sr. no. i. and ii. above, is not applicable to listed banks/NBFCs/insurance companies/housing finance companies)

iii. applicable terms, including covenants, tenure, interest rate and repayment schedule, whether secured or unsecured; if secured, the nature of security; and

iv. the purpose for which the funds will be utilized by the ultimate beneficiary of such funds pursuant to the RPT.

g. Justification as to why the RPT is in the interest of the listed entity;

h. A copy of the valuation or other external party report, if any such report has been relied upon;

i. Percentage of the counter-party’s annual consolidated turnover that is represented by the value of the proposed RPT on a voluntary basis;

j. Any other information that may be relevant.

(B) To Shareholders (as a part of explanatory statement of notice)

a. A summary of the information provided by the management of the listed entity to the audit committee as specified in paragraph 4 of this Section;

b. Justification for why the proposed transaction is in the interest of the listed entity;

c. Where the transaction relates to any loans, inter-corporate deposits, advances or investments made or given by the listed entity or its subsidiary, the details specified under para 4(f) above;

d. A statement that the valuation or other external report, if any, relied upon by the listed entity in relation to the proposed transaction will be made available through the registered email address of the shareholders;

e. Percentage of the counter-party’s annual consolidated turnover that is represented by the value of the proposed RPT, on a voluntary basis;

f. Any other information that may be relevant.